Pharma Industry and Innovations

For more than half a century, the traditional model of a pharmaceutical company have been the so-called Fully Integrated Pharmaceutical Company (FIPCO). Within the framework of this model, all activities are managed by the owner – a single company (TNC). The sheer size of such a TNC fosters incremental development but in general, is an obstacle to innovative development due to the lack of innovation dynamics. As a result, in the last decade, it has become clear that such a model cannot provide further sustainable growth.

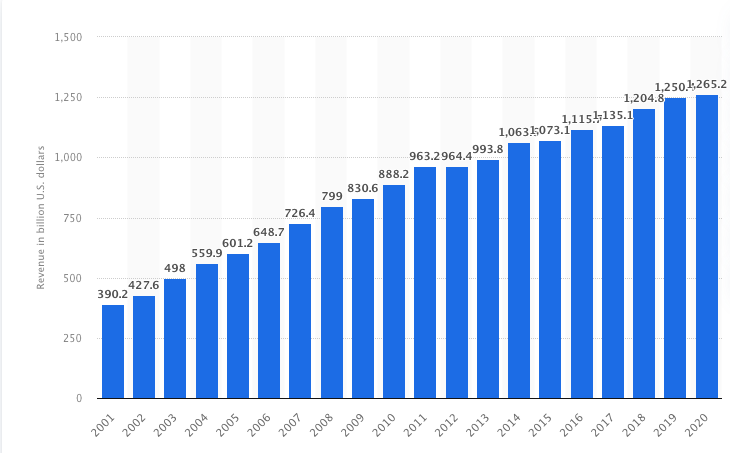

The duration of the research and production cycle, typical for the pharmaceutical industry, led to a gradual decline in R&D productivity, stretching the decisions made by TNCs over time. Eventually, the management of the largest companies began to move towards risk management through wider and more active use of partnerships, interaction with the academic sector and outsourcing of R&D. Companies began to pay more attention to highlighting the most promising areas of research, abandoning the principle “any new idea deserves in-depth study.” Functional organizational models have begun to give way to business units that focus on risk management and decisions based on economic feasibility. The significance of this shift is visible in Diagram 1, which shows revenue dynamics in the industry.

At the heart of the ongoing changes is the problem of the productivity of industry R&D. The colossal revenues of pharmaceutical TNCs from the sale of blockbuster drugs allowed them to create a complete closed cycle of drug production “in-house” – from expensive and complex R&D to clinical trials of all stages, marketing and market analytics of already released drugs. Nevertheless, against the background of growth in R&D expenses, the volume of new drug launches on the market did not increase.

It seems reasonable to state that indicators show an insignificant share of companies outside the top 15 of the global market. In fact, this means that in the global pharmaceutical industry, there is an established core of 15 companies that occupy more than half of the market. Outside the core, there are thousands of other companies that compete both with each other and with companies within the core. The core composition is constantly updated; some companies drop out of the leading group, then they can come back. This largely depends on the composition of the portfolio of the largest companies – if a company has been unable to produce and market innovative drugs for several years, then its share in the world market will decline. An acute dependence on innovation is a key feature of the work of companies in the industry. Against the background of the high sectoral competition, it should also be emphasized that the role of the largest TNCs, closing in on innovation activities, remains.

Despite the fact that R&D and high-tech manufacturing in pharmaceuticals account for a significant share of the cost of medicines and therefore are often used as an excuse for high prices for medicines, almost a third of the market value of medicines does not depend on companies. Price increases are provided by wholesalers, pharmacists and taxes. The pharmaceutical industry differs from other knowledge-intensive sectors in that the market it serves consists of more than just two common sides – supply and demand. The person who uses the medication is often not a market participant who pays for the product as it appears on the market. Typically, the medical costs of the drugs are borne by the insurance companies. They are also negotiating with manufacturers for discounts. If there is more than one prescription drug that contains the same formulas and indications, the insurance company can decide which drug a patient gets unless patients choose to pay the additional cost for the other drug themselves.

Consequently, demand is influenced by two participants: the patient, who wants the best treatment, and the insurance company, which is trying to save money by demanding discounts and the cheapest treatment possible. In addition, direct consumers are not aware of the demand and cannot directly influence it. The health status of the population drives demand. Even if consumers know what treatment they need to meet demand, they are not allowed to purchase the drug directly from the manufacturer. Consequently, a doctor is also the third market participant who influences demand.

Interestingly, if to consider only the US market, then the picture of the distribution of the role of core companies and smaller competitors is even more pronounced in favor of the largest TNCs. In 2006, the 15 largest pharmaceutical companies in the United States had a 66.6% share, which is significantly higher than the global figure. Thus, the US market is much more concentrated. Moreover, this concentration has increased over the past ten years. In 2016, the CR-15 in the US reached 68.3% (19). Of course, there was a reshuffle in the group of top 15 companies, and some previously large companies lost their positions. At the same time, others moved forward, and the oligopoly of the US pharmaceutical market became more pronounced.

The Herfindahl-Hirschman Index, which shows the degree of market concentration and is defined as the sum of the squares of the sales shares of each company in the industry, calculated both for the global pharmaceutical market and for the individual US market, has been in the 500-700 range over the past two decades. On the one hand, this indicates a moderate market concentration; on the other, the data show that in the United States, the core of 15 TNCs occupies a significantly larger share. However, the total number of companies on the market is huge. The largest companies constantly search for new opportunities and strive to take possession of promising developments of other companies. In recent decades, there has been an increase in M&A activity among companies in the industry.

Leading pharmaceutical corporations have been wary of the emergence of a new healthcare economy in recent years. It includes the use of information technology to consolidate the supply and distribution of medicines, which should increase the efficiency of healthcare (and, possibly, put even more pressure on the pricing policy of companies in the field of new drugs). Small niche companies developing medicines for rare diseases are becoming increasingly important in innovation processes. The requirements and expectations of patients who want personalized products are changing. As a result, the healthcare system will increasingly focus not on the volume of medical care but on its results. According to PwC experts, pharmaceuticals are becoming more consumer-oriented, the interaction of pharmaceutical TNCs with consumers is increasing – the latest drugs are sold directly to patients (expanding the clinical trial mechanism), and marketing strategies in the industry are changing.

Another trend in research and development is the use of advanced analytics (information technology development). Over the past decades, the volume and variety of medical information have expanded, largely driven by the industry’s innovative advances and the introduction of electronic patient records. Pharmaceutical companies gain access to a large amount of data, allowing for different prioritization of R&D and creating a portfolio of investigational active substances. Companies are seeking to lead the way in certain therapeutic areas, which raises the question of the potential end of the era of universal pharmaceutical TNCs dealing with all medical problems.

Here, it may be summarized that globalization has played a key role in the intensive growth of the pharmaceutical industry, stimulating an increase in product sales and growth in the capitalization of leading TNCs. At the same time, globalization has led to increased competition in the pharmaceutical market, the emergence of a powerful generics market and the erosion of the share of leading TNCs in it. The further development of the industry will depend on the innovative success in pharmaceuticals and the reaction of the leading TNCs to the ongoing changes. All the presented aspects justify the relevance of integrating new innovative technologies into the pharmacy industry, among which a significant role is given to blockchain.

Blockchain Essentials

Blockchain is a multifunctional and multilevel information technology designed for reliable accounting of various assets and transactions. In essence, the blockchain is an innovative paradigm for coordinating any activity, including inter-organizational coordination of supply chain counterparties. In technological terms (at the computational level), the blockchain, i.e., the chain of “blocks”, is a decentralized register of all transactions in a computer network. From the standpoint of supply chain management, it allows solving one of the most difficult problems in the implementation of inter-organizational coordination: ensuring the security (transparency) of information and the trust of contractors in the supply chain.

In the pharmaceutical industry, blockchain technologies are primarily used to monitor the supply of pharmaceutical products, including drugs that contain potent substances. Today, the patient cannot keep track of what drug he received, both in self-purchase and inpatient treatment. Although the patient has the right to demand, for example, a quality certificate for caviar, no one prevents an unscrupulous supplier or employee of a pharmacy from forging (falsifying) it. And if all the information is stored in the blockchain, starting from the moment of clinical research, production, subsequent storage and delivery to the pharmacy and/or its structural unit, medical institution, one can track the entire path of the drug. An important property of the blockchain is its immutability. Once stored in it, the information cannot be deleted.

Blockchain in Pharma

According to a new report, the market size for blockchain technology in healthcare will grow exponentially. The rise in popularity of blockchain technology for more reliable collection and storage of medical data (including during clinical trials) and improved patient care is associated with lower operating costs and ensuring data privacy. This, according to a new report from Global Market Insights, will boost this market segment to $1.6 billion by 2025. The expansion of the healthcare blockchain market is expected to result from investments in healthcare economics, medical data exploration and health data interoperability, which will drive the industry’s profitability and growth in the years to come.

In the pharmaceutical industry, counterfeit and falsified medicines pose a great risk to human health. These drugs can be not only ineffective but dangerous, causing side effects or even death. In addition, these counterfeit medicines can be manufactured in multiple locations – for example, chemically synthesizing in one country, adding fillers in another, and packaging in a third – making it difficult to track these moments and remove them from the supply chain in a timely manner. Hence, there is a need to introduce mechanisms to track medicines from the manufacturer to the consumer. Any of the participants in the circulation of medicines, be it a manufacturer, distributor, pharmacist, healthcare professional, or patient, can find out if a medicine is genuine.

There will be no centralized database element when the blockchain is integrated into this process. Advantages of this solution: the information that is recorded no longer depends on one server. The possibility of “problems” is excluded as such because all information is in a distributed ledger. Each operation is recorded and propagated between nodes in blocks that form a blockchain. If the classical database could be destroyed physically, interfere with its operation, or change any part of it, then in the case of the blockchain, it is impossible.

In this regard, this feature becomes its main advantage since it ensures the security of information when it is available to the necessary circle of people. At each stage, all information that can be provided by the relevant participant in the supply chain is recorded in the block. This information cannot be changed. In addition, as part of the normal product tracking process, a separate code was assigned and applied at each stage of packaging, from the blister to the pallet boxes. In the case of using blockchain technology, you can limit yourself to one QR code, which will display the information recorded in the blockchain.

At the end of the chain, when the drug is in the hands of the consumer, he can use this QR code to trace the entire path from production to the threshold. It is widely believed in the blockchain enthusiast society that the supply chain should be open, starting from raw materials. But suppliers of raw materials to pharmaceutical companies are trade secrets that they are unlikely to want to go public. For suppliers of raw materials, one can make a separate supply chain on the blockchain or within an exclusive blockchain, where access will be limited, and thus enterprises will not disclose all information about the supplier, publishing, for example, only the country from which the raw materials were imported.

The process of prescribing and purchasing prescription drugs also requires blockchain technology. Getting a paper prescription usually involves the doctor who prescribes the drug and the person who has prescribed the drug. Information about the prescribed drug is recorded in the medical record. It should be noted here that a clinical trial is a scientific study of the efficacy, safety and tolerability of medical products (including drugs) in humans. These studies can also show which medical approaches are best for certain diseases or groups of people. Clinical trials provide the best insight into data for health decision-making. Based on such blockchain elements as the presence of a timestamp, data immutability, and a distributed ledger, we will consider the use of blockchain technology to improve the process of clinical trials of drugs. The classic version of the clinical trial process is as follows.

Blockchain Scenario Example

A pharmaceutical company submits an application to the regulator to conduct clinical trials. The regulator will review and possibly approve the test. The pharmaceutical company appoints a research team, laboratory, or research contractor to manage the clinical trial. This team interacts with participants and collects data from clinical trials on behalf of the pharmaceutical company. Data can be collected through medical examinations, tests and questionnaires, etc. A pharmaceutical company analyzes data from clinical trials to assess the effectiveness and safety of medical products. The pharmaceutical company presents its results to the regulator to obtain approval for the use of a medical product. The regulator reviews this data and makes an approving or negative decision.

At each step of the above process, two or more parties interact with a specific set of data that requires validation and verification. Validation is confirmation, based on the provision of objective evidence, that the requirements for a particular use or application have been fulfilled. Verification is confirmation, based on the provision of objective evidence, that specified requirements have been met. This is due to the lack of trust between the participants in the clinical trial. Regulators, pharmaceutical companies and patients want transparency about healthcare products. In addition, each step in a clinical trial requires participants to have confidence in the information used in their decision-making. An example is a situation where ambiguous and conflicting information provided to regulatory authorities by pharmaceutical companies during clinical trials is a source of delays and inefficiencies.

Blockchain has the potential to provide a solution to a range of problems by creating a distributed ledger of documents, participants, and clinical trial data. This will increase the degree of transparency and trust between the parties in clinical trials. Blockchain can provide proof of data integrity during clinical trials since it is impossible to change prior blocks without anyone noticing it. In addition, all parties involved will also learn what has changed and who made the change. This is likely to reduce the incidence of errors or fraud when registering clinical trial data. Thus, both the pharmaceutical company and the regulator can trust the integrity of the data.

In terms of data privacy, the blockchain stores data in the form of hashes. Corresponding cryptographic keys are required to unlock the data. Patients participating in clinical trials can choose the encryption level and disclose only the part of the information that is needed. Blockchain enables data management of clinical trial participants. Patient consent plays an important role in the transfer of data to third parties. Lack of consent to the transfer of data or awareness contributes to inappropriate respect for patient rights. In the blockchain, participants can control when, with what information, how and to whom exactly clinical data is transferred. For this, smart contracts have been used that work according to predefined scenarios.

Moreover, blockchain can increase the efficiency of research in the field of creating new drugs. An example of this is the following case. The laboratory creates a protocol according to which it will conduct its research and testing. This protocol is written on the blockchain. If the research is successful, the results are recorded in the blockchain, and a “proof of existence” is created. Otherwise, if the research fails, then this is also recorded in the blockchain. Another laboratory working on a similar project may become familiar with this protocol and understand that it cannot be done in this way. There is an opportunity for these laboratories to unite for joint research using smart contracts.

Blockchain Significance

Traditional approaches to the exchange of health information are outdated; they do not address the problems in the modern healthcare system. In most cases, patients must bring all their previous medical records to the new institution or do medical tests. Apart from the obvious inconveniences, the lack of a patient’s medical history can lead to inappropriate treatment. Another issue is the lack of adequate information regarding patients and their medical history. Incomplete patient data may be abandoned in the databases of various hospitals. The importance of blockchain in pharmacy is presented in Table 1.

In order to assess the prospects for the introduction of digital logistics in pharmacy in the context of a pandemic, global trends in this area were analyzed. The following were identified as the main ones: end-to-end automation and integration of logistics processes into a single information system; transition to mandatory digitized technical documentation and electronic document management; the use of mobile technologies for monitoring, control and management of logistics processes in the promotion of pharmaceutical products; focus on segmentation of supply chains of pharmaceutical products and increasing the level of logistics services; improving the sustainability and reliability of pharmaceutical supply chains through the use of blockchain technology. It should be stressed that the pharmaceutical industry is characterized by a high level of regulation, certification and strict conditions for ensuring the quality of products, the need for its full compliance with the requirements of industry standards, the need to minimize, and ideally completely eliminate the human factor in production. That is why, according to experts, this industry in the future will play the role of one of the main generators of the digitalization of the economy.

For the supply chain, within which drugs are transported from pharmaceutical companies through distributors, pharmacies and medical institutions to the end consumer (patient), the most important task is to ensure the quality of pharmaceutical products. The problem of counterfeit drugs, in the context of a pandemic, is becoming more and more urgent, both from the point of view of economic costs and from the point of view of the risk to people’s lives.

Today, the market for counterfeit drugs in the world is estimated at USD 200 billion. 30% of drugs sold in developing countries are counterfeit, which led to the death of more than 100 thousand people in 2019 alone. The current situation with preventing counterfeit drugs from entering the pharmaceutical market can be overcome, as demonstrated in the previous section, thanks to the introduction of blockchain technology into the activities of participants in pharmaceutical supply chains. This makes it almost impossible for counterfeit and counterfeit pharmaceutical products to enter the supply chain, which is especially important in a pandemic.

Blockchain includes a complex code system for building trust without intermediaries. The information stored in the blocks is like the text on granite, which is nearly impossible to destroy, replace or erase; any change will be committed. There is no need for supervisory or regulatory bodies, and no central body can decide what is right and what is wrong. All participants must confirm that they agree with the general rules. If the blocks in such a system cannot be replaced, then this technology is indispensable for healthcare. Any user who changes the data in the medical record leaves their mark. The following cases show successful experience of blockchain implementation in the industry.

- Nebula Genomic. With this project’s advent, genome sequencing prices began to decline rapidly. In January 2017, the DNA sequencing company presented a new apparatus, which, according to the company, will be able to give results on the entire genome of one person for less than $ 100 in the near future. Nebula Genomic suggests that the sequencing capabilities of the human genome will soon create a billion-dollar genomic data market. The company will use Blockchain technology to improve the protection of genomic data, enabling buyers to efficiently purchase genomic data and solve genomic big data challenges.

- ConnectingCare. A convenient, innovative platform that brings together healthcare professionals from different organizations in one place. They are given the opportunity to view the data of general patients and, on this, build a more accurate prognosis for the disease. The platform works with sophisticated algorithms for diseases based on artificial intelligence, which makes it possible to more accurately predict the diagnosis. That being said, the best technology for solving data security problems and ensuring that data flows from the source to the end-user without intermediaries is blockchain.

- Doc.AI. This startup is introducing the ability to use the blockchain founded on artificial intelligence. In practice, anyone can run a program in which they enter their symptoms and answer a few specific questions. As a result, a predictive model will be modeled based on blockchain and AI. These data can be brought to the doctor for the purpose of subsequent treatment.

- Iryo. The enterprise has big plans for a global and participatory health ecosystem. The OpenEHR platform uses open source, i.e., medical data in this system will be completely immune to cybersecurity breaches, including government-sponsored attacks. The main goal of the platform is to combine all the user’s medical data in the Iryo system.

The analysis showed that the introduction of blockchain technology provides a number of opportunities and advantages. This technology will help solve a number of problems.

- Collect and make diagnoses based on a set of patient data. All this is possible only if a single ecosystem is formed around the technology, which will include devices for collecting and transmitting data about the user’s state.

- Keep any data protected. The basic rules for this are decentralization, the use of cryptographic keys, the promotion of network transactions, and the provision of security. This feature is very important in the medical industry since falsified/lost patient data can adversely affect his health.

- Control the quality of purchased drugs. Transportation of drugs to the final consumer is a long process, during which there may be cases of replacement of original drugs. Monitoring the entire supply chain and then recording this data will reduce the percentage of counterfeit shipments. The introduction of a blockchain-based tracking system for drugs and medical equipment will significantly improve the reliability of the supply of the desired product to the end consumer.

- Maintain medical records of patients in electronic form. This will allow medical staff to have access to patient data that was obtained from any of the medical institutions where he visited.

These advantages of blockchain will help solve a number of significant problems that are currently affecting the speed and quality of medical services provided.

Limitations of Blockchain

Blockchain is a relatively new technology, and not all stakeholders fully understand its potential. The economic feasibility of blockchain implementation is not always obvious, and for management and investors, it is often a key factor. From a technical point of view, blockchain also has certain problems. Blockchain bandwidth can be negatively affected by less secure but more traditional mechanics. Due to the newness of the technology, its principles have not yet been formed. This leads to the incompatibility of some related approaches and issues with the scope.

It should be admitted that not only top managers but also doctors and patients do not fully trust the blockchain. Not every individual will agree to place their personal data in a system, the principle of which they do not realize. The following limitations of blockchain can be distinguished.

- It is assumed that smart contracts, one of the central elements of the technology, will be a paper-electronic hybrid (confirmed by the blockchain, then printed as a paper copy) and then completely transformed into digital embodiment. The key problem here is the “correctness” of the smart contract (in fact, the program code), its compliance with the agreements concluded. How and by whom to confirm it?

- It is declared that blockchain technologies will help to simplify document flow, detect errors or thefts, and monitor the fulfillment of the terms of the contract. However, this is impossible without the full and widespread implementation of the so-called “Internet of Things”, which may require even more costs and effort than blockchain.

- For the effective functioning of blockchain technologies, a single industry environment must be created. However, the logistics business is constantly changing, which complicates the provision of the correct operation of smart contracts. In addition, one of the basic principles of blockchain – data transparency – does not fit well with the issue of trade secrets.

- In the case of using a private, not a public, blockchain network, the question of dependence on the operator of this network arises.

- There is also a problem of scale or network effect: the more participants in one or another logistics blockchain solution, the more useful this solution is. However, the network effect complicates the work from the very beginning, at the start of the project, and large companies can put pressure on partners in the supply chain, requiring mandatory participation.

To summarize this chapter, it was claimed that within the scope of pharma, blockchain contributes to privacy in terms of patient data, averts issues related to false drugs, stimulates R&D activities and relations, and advances supply chains. The crucial flaws are related to the complexity of blockchain’s appropriate implementation, the considerable extent of personnel’s competencies (at all levels), and significant expenses. However, the industry’s trends show that the mentioned advantages are essential, and the global shift to blockchain in pharmacy is inevitable.

Reference List

Sylim P, Liu F, Marcelo A, Fontelo P. Blockchain technology for detecting falsified and substandard drugs in distribution: Pharmaceutical supply chain intervention. JMIR research protocols. 2018; 7(9): e10163.

Nørfeldt L, Bøtker J, Edinger M, Genina N, Rantanen J. Cryptopharmaceuticals: increasing the safety of medication by a blockchain of pharmaceutical products. Journal of pharmaceutical sciences. 2019;108(9): 2838–2841.

Uddin M, Salah K, Jayaraman R, Pesic S, Ellahham S. Blockchain for drug traceability: Architectures and open challenges. Health Informatics Journal. 2021; 27(2). doi: 10.1177/14604582211011228.

Radanović I, Likić R. Opportunities for use of blockchain technology in medicine. Applied health economics and health policy. 2018; 16(5): 583–590.

Agbo CC, Mahmoud QH, Eklund JM. Blockchain technology in healthcare: A systematic review. Healthcare (Basel). 2019;7(2):56.

Justinia T. Blockchain Technologies: Opportunities for Solving Real-World Problems in Healthcare and Biomedical Sciences. Justinia T. (2019). Blockchain technologies: opportunities for solving real-world problems in healthcare and biomedical sciences. Acta Informatica Medica. 2019; 27(4): 284–291.

Langley PC, Martin RE. Blockchains, property rights and health technology assessment in the pharmaceutical and device(s) industries. Innovations in Pharmacy. 2018; 9(4). Doi: 10.24926/iip.v9i4.1444

Mackey TK, Kuo TT, Gummadi B, Clauson KA, Church G, Grishin D, Obbad K, Barkovich R, Palombini M. ‘Fit-for-purpose?’ – challenges and opportunities for applications of blockchain technology in the future of healthcare. BMC Med. 2019; 17(1): 68.

Tagde P, Tagde S, Bhattacharya T, Tagde P, Chopra H, Akter R, Kaushik D, Rahman MH. Blockchain and artificial intelligence technology in e-Health. Environmental science and pollution research international. 2021; 1–22.

Uddin M, Salah K, Jayaraman R, Pesic S, Ellahham S. Blockchain for drug traceability: Architectures and open challenges. Health Informatics Journal. 2021. doi:10.1177/14604582211011228.

Kamel Boulos MN, Wilson JT, Clauson KA. Geospatial blockchain: promises, challenges, and scenarios in health and healthcare. International journal of health geographics. 2018; 17(1). doi: 10.1186/s12942-018-0144-x.

Gregório J, Cavaco A. The pharmacist’s guide to the future: Are we there yet? Research in social & administrative pharmacy. 2021; 17(4): 795–798.

Mackey TK, Nayyar G. A review of existing and emerging digital technologies to combat the global trade in fake medicines. Expert opinion on drug safety. 2017; 16(5): 587–602.

Aldughayfiq B, Sampalli S. Digital health in physicians’ and pharmacists’ office: A comparative study of e-prescription systems’ architecture and digital security in eight countries. OMICS. 2021; 25(2): 102–122.

Langley PC. Information or evidence? abandoning imaginary worlds for blockchains in health technology assessment. Innovations in pharmacy. 2018; 9(3): 1–5.

Langley PC, Martin RE. If you build it will they come? Patients, providers and blockchains in health technology assessment. Innovations in pharmacy. 2018;9(4). doi: 10.24926/iip.v9i4.1453.

Erokhin A, Koshechkin K, Ryabkov I. The distributed ledger technology as a measure to minimize risks of poor-quality pharmaceuticals circulation. Peer J. Computer science. 2020; 6: e292.

The Medical Futurist. Top 12 companies bringing blockchain to healthcare.

Richman B, Mitchell W, Vidal E, Schulman K. Pharmaceutical M&A activity: Effects on prices, innovation, and competition, Loyola University Chicago Law Journal. 2017; 48: 787–819.

Global Market Insights. Blockchain technology in healthcare market 2019-2025 share statistics.

McCauley A. Why big pharma is betting on blockchain. HBR.

Kaur D. How blockchain adds value to the pharmaceutical industry. T_HQ.

Mikulic M. Revenue of the worldwide pharmaceutical market from 2001 to 2020. Statista.

Coinpaprica. Pact white paper.

de la Torre BG, Albericio F. The pharmaceutical industry in 2019. An analysis of FDA drug approvals from the perspective of molecules. Molecules. 2020; 25(3). doi: 10.3390/molecules25030745.

Schuhmacher A, Gassmann O, Hinder M. Changing R&D models in research-based pharmaceutical companies. Journal of translational medicine. 2016; 14(1). doi: 10.1186/s12967-016-0838-4.

Thought Leadership. How blockchain can reduce waste for pharmaceutical companies. Finance Magnets.